One of the key metrics that investors and analysts use to evaluate the performance and health of a business is operating income. It measures how much profit a company makes from its core activities, excluding the effects of financing and taxes. In this article, we will explain what operating income is, how to calculate it using different methods, and why it matters for business analysis and decision making.

How to Calculate?

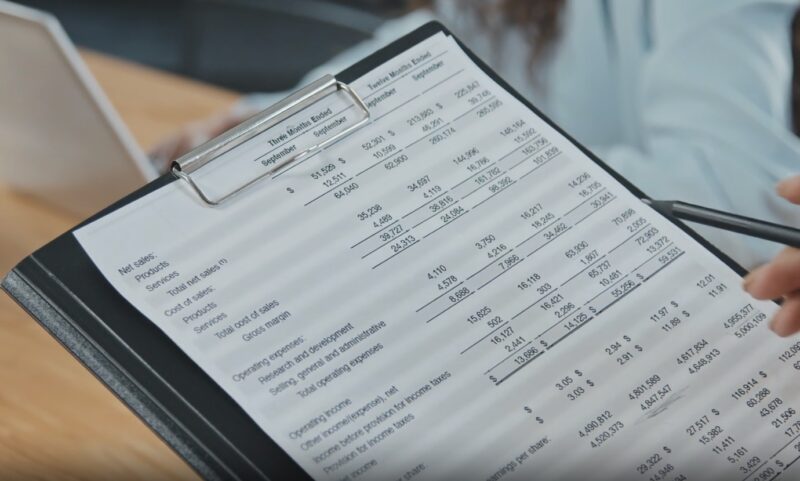

Operating income is a measure of how much profit a company makes from its core business activities. It is also known as operating profit or earnings before interest and taxes (EBIT). It reflects the efficiency and profitability of a company’s operations, excluding the effects of financing and taxes. There are three main ways to calculate it:

- Operating income = Total revenue – Direct costs – Indirect costs

- Operating income = Gross profit – Operating expenses – Depreciation – Amortization

- Operating income = Net income + Interest expense + Taxes

Each method has its advantages and disadvantages, depending on the type and complexity of the business. You should also learn more about state tax lien.

| Method | Formula | Advantages | Disadvantages |

|---|---|---|---|

| Top-down | Operating income = Total revenue – Direct costs – Indirect costs | – Simple and intuitive – Shows the contribution of each cost category to the operating income | – May not capture all the relevant costs – May not be consistent with the accounting standards |

| Bottom-up | Operating income = Gross profit – Operating expenses – Depreciation – Amortization | – More accurate and comprehensive – Aligns with the accounting standards | – More complex and time-consuming – Requires more data and assumptions |

| Net income | Operating income = Net income + Interest expense + Taxes | – Easy and convenient – Uses readily available data | – May not reflect the true operating performance – May be affected by non-operating items |

Total Revenue – Direct Costs – Indirect Costs

This method is also known as the top-down approach, as it starts with the total revenue and subtracts the costs associated with producing and selling the goods or services. Direct costs are the expenses that can be directly traced to the products or services, such as raw materials, labor, and commissions.

Indirect costs are the expenses that are not directly related to the products or services, but are necessary for running the business, such as rent, utilities, and administration.

Example: D Trump footwear company earned total sales revenues of $25M for the second quarter of the current year. For that period, the cost of raw materials and supplies used for the sold products was $9M, labor costs directly applied were $2M, administrative and staff salaries totaled $4M, and there were depreciation and amortizations of $1M. As a result, the income before taxes derived from operations gave a total amount of $9M in profits.

It is simple and intuitive, as it shows the contribution of each cost category. It also allows for easy comparison of the performance of different businesses, as it does not depend on the accounting methods of depreciation and amortization.

However, it may not capture all the relevant costs that affect the operations, such as research and development, marketing, and advertising. Moreover, the downsides is that it is not consistent with the accounting standards, as some indirect costs could be allocated to the products or services based on arbitrary rules.

Gross Profit – Operating Expenses – Depreciation – Amortization

This method is also known as the bottom-up approach, as it starts with the gross profit and subtracts the expenses and the non-cash charges of depreciation and amortization. Gross profit is the difference between the total revenue and the cost of goods sold (COGS), which is the direct cost of producing the goods or services.

The expenses are the costs incurred to run the business, such as selling, general, and administrative (SG&A) expenses. Depreciation and amortization are the accounting methods of allocating the cost of fixed assets and intangible assets over their useful lives.

Example: Amazon.com Inc. reported a total revenue of $136B and a COGS of $88B for the year 2016. The company also incurred operating expenses of $37B, depreciation of $7B, and amortization of $1B. Therefore, the operating income for the year 2016 was $3B.

It is more accurate and comprehensive, as it captures all the relevant costs that affect the operations, including the non-cash charges of depreciation and amortization.

It also aligns with the accounting standards, as it follows the same format as the income statement. However, this method is more complex and time-consuming, as it requires more data and assumptions to calculate the COGS, the operating expenses, and the depreciation and amortization.

Net Income + Interest Expense + Taxes

This method is based on the idea that operating income is the income before deducting the non-operating expenses of interest and taxes. Net income is the bottom line of the income statement, which shows the profit or loss after all expenses, including interest and taxes, have been accounted for.

Interest expense is the cost of borrowing money from lenders or creditors. Taxes are the payments made to the government based on the taxable income of the business.

Example: Apple Inc. reported a net income of $57B, an interest expense of $1B, and a provision for income taxes of $16B for the year 2019. Therefore, the operating income for the year 2019 was $74B. The main benefit is that it is easy and convenient, as it uses readily available data from the income statement.

It also allows for a quick estimation of the operating income without requiring detailed calculations. However, it may not reflect the true operating performance of the business, as it may be affected by non-operating items, such as gains or losses from investments, extraordinary items, or discontinued operations. Moreover, this approach may not be comparable across different businesses, as they may have different financing structures and tax rates.

FAQs

What is the difference between operating income and net income?

Operating income is the income before deducting the non-operating expenses of interest and taxes, while net income is the income after deducting all expenses, including interest and taxes. The first one reflects the profitability of the core business activities, while net income reflects the profitability of the entire business.

How can operating income be increased?

It can be increased by either increasing the total revenue or decreasing the total costs. Some strategies to increase the total revenue are: expanding the market share, launching new products or services, raising the prices, or improving the quality or customer service.

Some strategies to decrease the total costs are: reducing the direct or indirect costs, optimizing the production or distribution processes, outsourcing or automating some tasks, or negotiating better deals with suppliers or creditors.

What is the difference between operating income and EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is similar to operating income, but it does not subtract the non-cash charges of depreciation and amortization. EBITDA is often used as a proxy for cash flow, as it shows how much cash a company generates from its operations, before accounting for the cost of capital and taxes.

How can operating income be negative?

It can be negative if the total costs exceed the total revenue. This means that the company is losing money from its core business activities, and it is not covering its operating expenses. A negative income indicates that the company is inefficient or unprofitable, and it may face financial difficulties or bankruptcy in the long run.

How can operating income be manipulated?

It can be manipulated by using different accounting methods or practices, such as changing the depreciation or amortization rates, allocating the indirect costs differently, or recognizing the revenue or expenses earlier or later. These practices can affect the calculation of operating income, and make it appear higher or lower than it actually is.

How can operating income be compared across different companies or industries?

It can be compared across different companies or industries by using margin, which is the ratio of operating income to total revenue. Operating margin shows how much of each dollar of revenue is left as operating income, and it reflects the profitability and efficiency of the operations.

Conclusion

Operating income is a key metric that shows how much profit a company makes from its core business activities, excluding the effects of financing and taxes. It reflects the efficiency and profitability of a company’s operations, and can be used for various purposes, such as comparing different companies, evaluating growth potential, and assessing the impact of business decisions.

Each method has its advantages and disadvantages, depending on the type and complexity of the business. Therefore, it is important to understand the underlying assumptions and limitations of each method, and to use the most appropriate one for the specific situation and purpose.