Millage rates play a pivotal role in determining your property tax bill. As an owner, understanding how these rates are calculated can empower you to better manage your finances and anticipate your obligations.

Now, we will walk you through the specifics of these rates, ensuring you have the knowledge to calculate your dues accurately.

Why is This Rate Important?

At its core, a millage rate is a tax rate expressed in mills. One mill represents one-thousandth of a dollar or $1 of tax for every $1,000 of assessed value. Fundamentals:

- Definition: It is a rate used to calculate local property taxes.

- Expression: It is typically expressed in mills, which is equal to $1 of tax per $1,000 of assessed value.

The Main Components

Millage rates are not pulled out of thin air; they are carefully calculated by local entities to meet the community’s financial needs. Entities That Set Rates:

- Local Governments: City and county governments determine their own rates to fund various services.

- School Districts: Separate rates are often set to support public schools.

- Special Districts: Fire departments and libraries may have their own levied rates.

Contribution to Overall Bill

The millage rate is a significant factor in your property tax bill.

Each entity calculates its required rate based on its budget and divides this by the total assessed value in its area to determine the rate.

The individual ones are then aggregated to form the total rate applied to a property.

Importance for Owners and Taxpayers

For homeowners and landowners, a clear comprehension of millage rates is indispensable. These rates not only influence the amount of property tax due each year but also affect the overall value and desirability within a community.

When they increase, the tax burden on a property owner rises accordingly. Conversely, a decrease in millage rates can signal a reduction in tax liability.

Owners who are well-informed about rates can better manage their finances, challenge their property assessments if they seem unfair, and actively participate in local government decisions that could impact these.

Step-by-Step Guide

Now, let us go through the steps to calculating this rate properly.

Step 1: Identifying the Assessed Value

The assessed value of a property is a valuation placed on a property by a public tax assessor for the purpose of taxation. It is important to note that this assessed value can differ significantly from the market value, which is the price it might fetch on the open market.

The assessed value is often a percentage of the market value, determined by the assessment ratio set by the authority. This ratio can vary greatly from one jurisdiction to another and may change from year to year.

Finding Your Property’s Assessed Value

To find the assessed value of your property, you can look at your most recent tax bill, visit the local assessor’s office, or access their website.

Many jurisdictions provide online databases where owners can search for their property by address or parcel number to find the assessed value.

This value is crucial because it is the figure to which the millage rate is applied to determine the tax.

Step 2: Gathering Rates

Local millage rates are typically a matter of public record and can be found in several places.

Most commonly, they are listed on the tax bill sent to homeowners.

If not, the local assessor’s office or website will have this information available. In some cases, local newspapers or official bulletins will publish rates, especially if there has been a recent change.

Different Types

The total millage rate applied to a property is often a combination of several different millage rates.

These can include:

- A county rate, which funds county services.

- A city or township rate, if it is located within a city or township.

- A school district rate, which funds the local public schools.

- Special district rates, which fund specific services like water and sewer improvements.

Each of these rates is determined independently but collected together as part of the property tax bill.

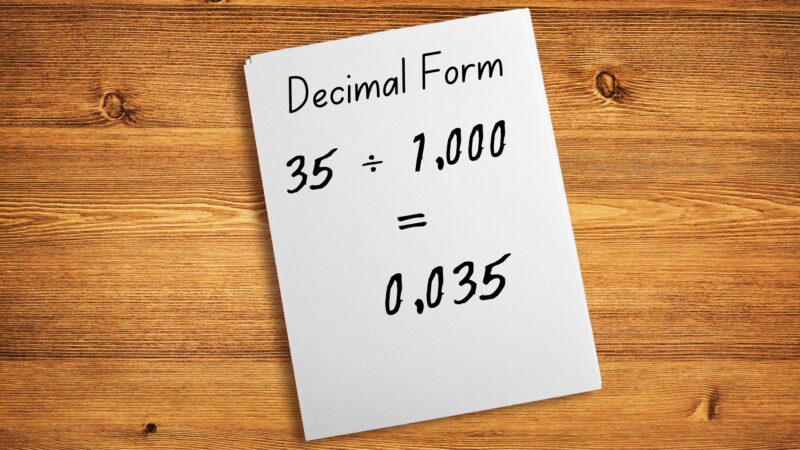

Step 3: Converting Millage Rates to Decimal Form

To calculate the tax, you must first convert the rate from mills to a decimal form. This is done by dividing the millage rate by 1,000. For example, if the total rate is 35 mills, you would convert it to 0.035 (35 / 1,000) for use in calculations.

Step 4: Calculating the Tax

Formula The formula for calculating property tax using the millage rate is straightforward: Property Tax = Assessed Value × (Total Millage Rate in Decimal Form) Property Tax=Assessed Value×(Total Millage Rate in Decimal Form)

An Example

Let’s say the assessed value of your property is $250,000, and the total rate is 40 mills.

First, convert the rate to a decimal, which gives you 0.040. Then, multiply the assessed value by the decimal millage rate: Property Tax = $ 250 , 000 × 0.040 = $ 10 , 000 Property Tax=$250,000×0.040=$10,000

This means you would owe $10,000 in property taxes for the year.

Factors That Might Affect It

Millage rates are not static; they can change for a variety of reasons.

If the budgetary needs of a taxing authority increase, due to factors such as inflation, increased service demands, or capital project financing, the authority may decide to raise them.

Conversely, if a taxing authority finds that it requires less revenue—perhaps because of budget cuts, efficiency improvements, or an increase in the tax base—it may lower the millage rate.

Impact of Public Services

The quality and scope of public services have a direct impact on rates.

If residents demand better schools, improved roads, or enhanced public safety, the funding for these services typically comes from property taxes, which may necessitate an increase in millage rates.

On the other hand, if the community is willing to accept fewer or lower-quality services, or if other revenue sources are developed, rates may not need to be as high.

FAQs

Can I calculate my property taxes if I know the millage rate but not the assessed value?

No, you need both the millage rate and the assessed value to calculate your property taxes. If you don’t have the assessed value, you can usually obtain it from your local tax assessor’s office.

Are there any online calculators that can help me determine my property taxes using the millage rate?

Yes, some local government or assessor websites offer online calculators where you can input your property’s assessed value and the local millage rate to estimate your property taxes. Additionally, there are third-party websites and financial tools that can assist with these calculations.

How can I lower my property taxes if the millage rate is high?

While you cannot directly lower the millage rate, you can ensure your property is assessed fairly and take advantage of any exemptions or deductions for which you may be eligible. Additionally, participating in local government meetings and voting on related issues can influence future rates.

Does renovating my property affect the millage rate?

Renovating your property won’t affect the rate, but it could increase your property’s assessed value, which could result in higher taxes. It’s important to report any significant improvements to your local tax assessor’s office.

The Bottom Line

Millage rates are a fundamental aspect of property ownership and taxation. They are the tool by which property taxes are calculated and collected to fund various public services within a community. Understanding how these rates are set, how they can change, and how they are applied to the property is essential for any owner.

It enables effective financial planning and informed participation in local governance. Owners should stay vigilant about changes in rates and seek assistance from tax professionals or local authorities for accurate calculations and advice.

Learning more about taxes is essential. For similar subjects, check our website.