True cost of employment is crucial for businesses aiming to manage their finances effectively. The burden rate is the tool used to uncover these often unseen expenses. It encapsulates all of the indirect costs associated with maintaining an employee, in addition to their direct salary. These costs include benefits, payroll taxes, equipment, and training fees. Knowing the burden rate is important because it impacts pricing, budgeting, and profitability assessments.

Calculating the burden rate involves adding together all the indirect costs that a company incurs for an employee and expressing it as a percentage of their direct wages. For example, if a company spends $30,000 in total on indirect costs for an employee whose salary is $70,000, the burden rate would be approximately 42.9%. This metric is essential for decision-making, as it shows how much a company realistically spends beyond the base salary to employ a worker, and it feeds into strategic planning, especially in labor-intensive industries.

Key Takeaways

- The burden rate provides a complete picture of employment costs, including both direct wages and indirect expenses such as benefits and equipment.

- Accurate calculation of the burden rate is crucial for setting appropriate prices and budgeting, ensuring all costs are covered for profitability.

- Knowing the burden rate aids in making informed decisions in financial planning, resource allocation, and overall business strategy.

- It brings to light the hidden or indirect costs associated with employment, offering a clearer understanding of the true cost of labor.

- The burden rate is a dynamic metric that needs regular updating to reflect changes in business conditions, aiding in maintaining financial health and competitiveness.

Overview

When you manage a business, grasping the full cost of operations is crucial. Burden rates provide a complete picture by accounting for the indirect costs of employment or production.

Burden rate is the indirect costs associated with employees or production that go beyond direct labor or materials expenses. It includes additional costs such as benefits, payroll taxes, and facilities expenses. For employees, it’s essential to calculate the burden rate to understand the true cost of labor.

In cost accounting, burden rates are pivotal for budgeting and financial planning. They help you determine the true cost of projects and products by revealing hidden expenses. Understanding these rates ensures pricing models cover all costs, maintaining profitability.

Calculating Burden Rates

In business, the accurate calculation of burden rates is essential for pricing products and services effectively. Here is how you can determine your company’s burden rates.

Components

The burden rate comprises both the direct and indirect costs associated with employees. Direct costs are the wages that you pay employees for the work they perform. Indirect costs, on the other hand, include additional expenses such as:

- Payroll taxes

- Employee benefits (health insurance, retirement plans)

- Paid leave

- Worker’s compensation

- Equipment or supplies that employees use

- Training and development costs

It’s crucial to identify all these components correctly to ensure that the burden rate calculation reflects the true cost of employment.

Step-by-Step Calculation Method

To calculate your company’s burden rate, follow these steps:

- Compile Indirect Costs: Sum all the indirect costs over a specific period. This includes all the items listed in the components section above.

- Determine Total Direct Labor Costs: Add up the wages paid to your employees during the same period.

- Calculate the Burden Rate: Divide the total indirect costs by the total direct labor costs. The formula is as follows:[ \text{Burden Rate} = \left( \frac{\text{Total Indirect Costs}}{\text{Total Direct Labor Costs}} \right) \times 100 ]

The result is a percentage that represents the additional cost over and above the direct labor costs.

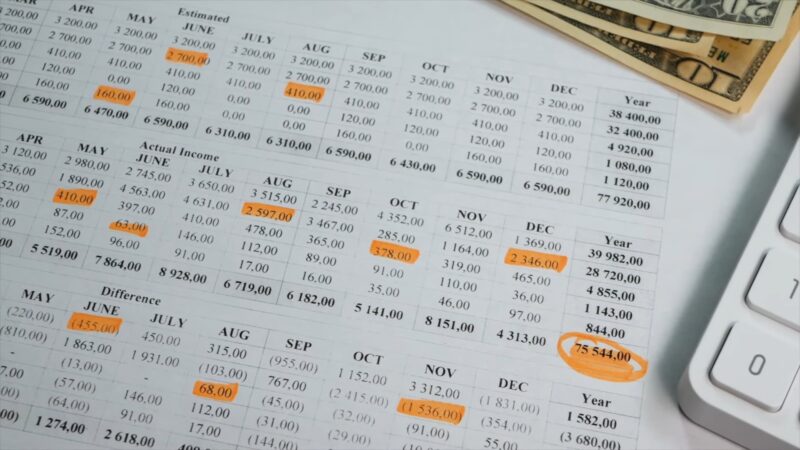

For example, if your indirect costs are $30,000 and your direct labor costs are $50,000, your burden rate would be 60%. This means for every dollar you spend on wages, an additional $0.60 is spent on indirect expenses. By understanding this number, you can more accurately price your products or services to cover all expenses and achieve desired profit margins.

Application

In business finance, understanding the burden rate is crucial for accurate financial analysis. It plays a pivotal role in cost management and pricing strategies across departments.

Project Cost Estimation

When determining the true cost of a project, your calculation must include both direct and indirect expenses. The burden rate becomes vital here as it includes costs such as employee benefits, office space rent, and utilities.

By using the burden rate to evaluate project costs, you ensure a comprehensive financial picture, which includes hidden expenses that are often overlooked in initial estimates.

Pricing Strategy

For a product or service to be profitable, its selling price must cover all costs, including the often invisible indirect ones. Here, applying the burden rate assists in identifying the full cost of your offerings. This full costing methodology enables you to establish a pricing strategy that not only recovers all your costs but also targets desired profit margins.

Budgeting and Financial Planning

A properly calculated burden rate is an indispensable element in budgeting and financial planning. It helps you forecast future expenses with greater precision, allowing for a more effective allocation of resources. Knowledge of your total cost burden aids in maintaining financial health by safeguarding against under-budgeting for labor and operational costs.

Challenges in Applying Burden Rates

When you calculate burden rates, you face complexities due to differing circumstances and methodologies that can affect accuracy and relevance.

Variability and Uncertainty

Variability in operating costs can significantly impact your burden rate calculations. Seasonal fluctuations and market changes often lead to unexpected costs that are difficult to predict and can make your burden rate less stable. For example, during high-demand periods, overtime pay can increase the indirect labor costs, subsequently affecting the burden rate.

Uncertainty also comes from external factors such as regulatory changes or economic downturns. These unpredictable elements can abruptly alter the burden rate, posing challenges when you try to maintain consistency in your cost analysis and pricing strategies.

Allocation Methods

Choosing the right allocation method for your burden rate is crucial. Two common methods are:

Direct Allocation:

- Applicable direct costs are assigned to specific projects or departments.

- Greater accuracy but can be time-consuming.

Indirect Allocation:

- Costs are spread across different departments based on a pre-defined formula.

- More efficient but could lead to less precise cost distribution.

Your choice of allocation method affects not only the accuracy of the burden rate but also how well it reflects the true costs of maintaining your business operations. Incorrect methods can lead to misleading financial analysis, which can impact decision-making processes related to pricing and budgeting.

Improving Accuracy

To enhance your decision-making and financial planning, maintaining an accurate burden rate is critical. This metric reflects the indirect costs of employment or manufacturing beyond direct labor costs, and its precision can directly impact your profitability and pricing strategies.

Data Collection and Analysis

The first step is ensuring that data collection is comprehensive. You need to gather all relevant information about indirect costs, which may include employee benefits, training, utilities, and equipment depreciation. Use data analysis tools and techniques to segment these costs effectively, assigning them properly to different departments, projects, or products.

- Collect: Gather detailed data on all indirect costs.

- Analyze: Use data segmentation to associate costs with the correct business areas.

Regular Review and Adjustment

Given that business conditions and cost structures evolve, your burden rate should not remain static. Regularly review financial statements and market conditions to identify changes that could affect your burden rate. Make necessary adjustments to the burden rate to reflect current realities, which may involve updating allocation methods or cost drivers.

- Review: Schedule consistent evaluations of burden rate components.

- Adjust: Update the burden rate to align with recent financial and operational data.

Frequently Asked Questions

How is the burden rate calculated in a business context?

The burden rate is determined by adding indirect costs, such as employee benefits, payroll taxes, and equipment costs, to the direct costs of labor. This sum is then divided by the direct labor cost and expressed as a percentage.

What factors typically contribute to an employee’s burden rate?

Factors contributing to an employee’s burden rate include non-wage costs like employer-paid taxes, insurance, retirement contributions, and any other benefits provided. Training and certification costs, if paid by the employer, may also contribute.

In what ways does the burden rate differ from the labor rate?

The burden rate includes both direct and indirect labor costs, whereas the labor rate only accounts for the actual wages paid to employees. The burden rate paints a more comprehensive picture by considering the full cost of employing staff.

Can you provide an example of how burden cost is applied in manufacturing?

In manufacturing, burden cost includes expenses such as the cost of maintaining and operating machinery, utility costs for the production floor, and wages of indirect labor.

What methods are used to calculate the machine burden rate?

To calculate the machine burden rate, you would typically divide the total indirect costs of running a machine—such as depreciation, maintenance, and energy costs—by the number of hours the machine is in operation.

How does the burden rate affect budgeting and cost management in project management?

The burden rate is critical in project management for accurate budgeting and cost control as it helps in determining the true cost of labor used on a project. By including indirect costs, managers can assess project profitability and make informed pricing and bidding decisions.

Final Words

Understanding and accurately calculating the burden rate is fundamental for businesses to gain insight into the true cost of employment or production. This crucial metric guides strategic decisions in pricing, budgeting, and financial planning, ensuring that all costs are accounted for and profitability is maintained.